Underneath Capitalisation Of An Organization: Meaning And Causes

Thus, by this simple system the management can neutralize the results of under-capitalisation and save the corporate from any eventuality. Establishment of increasingly more firms and enlargement of existing ones helps to mitigate sufferings of unemployed persons. Buying energy of newly employed individuals increases resulting in a rise in demand which, in turn leads to enhance in funding and production. Through demand-investment and employment spiral the financial system marches ahead to succeed in the top of prosperity. By analyzing these tendencies and making use of the lessons discovered, businesses can create a more resilient monetary technique to mitigate undercapitalization risks. Develop detailed budgets and cash flow forecasts that account for working bills, tax obligations, and unexpected costs.

Under-capitalisation: Idea, Causes And Cures Monetary Administration

In such a scenario, there might be larger price of returns than warranted by the book- figures. Typically the promoters find it tough to procure the required quantity of capital. But even then the administrators https://www.1investing.in/ feel worthwhile to start the work of the corporate.

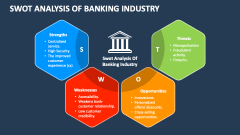

In the banking business, undercapitalization refers to having inadequate capital to cover foreseeable dangers. However, as decided in Walkovszky v. Carlton, the mother or father corporation just isn’t liable for settling claims in excessof remaining belongings when an undercapitalized subsidiary fails. As a consequence of under-capitalisation, the businesses earn big profits and consequently, the burden of tax is nice.

This was required may be due to the altering market conditions. In this process the product strains become unduly complicated and lengthy with too many variants, shapes or sizes. In the current scenario it thoughts discover out that efforts behind all these variants is resulting in causes of under capitalisation non-optimal utilisation of assets. In different words it could be profitable for the corporate to depart behind some of the variants. This would lead to improve in actual value of property while e-book worth of belongings stays as before and the consequence can be under-capitalisation.

Streamline Money Flow Management

Undercapitalization when it comes to enterprise means a situation the place a business faces a scarcity of funds or capital requirements to proceed its day-to-day operations. This is prevalent or typically seen as an issue with small enterprise corporations. The business in these moments also faces the lack of capacity to acquire any new supply of funding or capital. Under-capitalization can pose vital challenges to an organization’s development and stability. By identifying its causes and implementing acceptable remedies, an organization can improve its financial health and competitiveness out there. A contrary view comes from the economist Robert Solow, who was awarded the Nobel prize for his work on the methods during which labor, capital and technical progress contribute to total financial progress.

For occasion, LCD, CD- ROM drive and joystick are various objects under palm top product type. A group of merchandise inside a product class which are intently associated as a result of they perform an analogous perform, are offered to the identical buyer groups, are marketed by way of the identical channels or fall within given worth vary. A group of products throughout the product household recognised as having a certain functional coherence. For instance, private laptop (PC) is one product class. The marketer at this stage has to turn the core profit to a primary product.

- (i) The root reason for underneath capitalisation is the tremendous elevated incomes capability of the company by no matter factors brought on.

- Quickonomics offers free access to training on financial subjects to everybody around the globe.

- The founders initially funded the corporate utilizing their private savings and a mortgage from a local bank.

- If an organization has enough surplus in hand the entire or a part of it can be capitalized by problem of bonus shares.

Indicators Of Undercapitalization:

Administration might cut back incomes per share if it so likes by taking recourse to inventory split. Thus, under-capitalisation is indicative of sound monetary health and good management of the corporate. Bonneville and Dewey rightly noticed that “Under-capitalisation is not an economic drawback however an issue in adjusting the capital structure”. Maybe the most effective remedy for underneath capitalisation is the conversion of reserves into shares. This will serve two functions — reducing both dividend per share and the general rate of earnings. Efficient cash circulate administration is critical to keep away from liquidity crunches.

The other drawback is that it could prohibit the firm from increasing or investing in other ventures. With sufficient capital, every agency will find it extraordinarily troublesome to venture into new areas or broaden. Under-capitalisation finally results in over-capitalisation because of excessive profits, huge retained earnings and long-term debt financing.

This thus goes a long way in enhancing earning position of the company. Under-capitalisation is an index of effective and proper utilisation of funds employed within the enterprise. Sudden enhance in earnings during prosperity in case of companies floated in recession. This signifies that the enterprise cycle movements can cause under-capitalisation. Undercapitalization occurs when a business lacks sufficient funds to cover its operational wants or pursue growth alternatives. It can lead to operational disruptions, elevated debt, and financial instability.

Under-capitalization is the reverse, the place a company earns extraordinarily high returns over its capital. Causes of over-capitalization embody excessive buy of fastened property and liberal dividend policies. Causes of under-capitalization embody excessive effectivity and conservative dividend policies. Each conditions can impact firms, stockholders, society, and staff negatively.